The accounting industry has undergone tremendous transformations over the past few decades. From paper-based ledgers to sophisticated spreadsheets, accounting practices have become more streamlined and efficient. However, the introduction of IoT in Accounting has marked a new era, shifting the focus from manual and semi-automated systems to fully connected and intelligent frameworks.

With advancements in Artificial Intelligence Services, Machine Learning Services, and cloud computing, accounting has become more proactive, accurate, and data-driven. IoT-enabled smart systems now allow organizations to track, monitor, and analyze financial transactions in real-time, ensuring seamless financial management. This article explores the evolution of accounting systems, the role of IoT, and how businesses can leverage this technology to improve financial operations.

- The IoT market is expected to grow to $650 billion by 2026.

- 70% of businesses are expected to adopt IoT in accounting by 2025.

- Companies using IoT have reported a 30% reduction in operational costs.

Table of Contents

- Understanding IoT in Accounting

- The Transition: From Spreadsheets to Smart Systems

- The Evolution of Accounting Systems

- How IoT is Revolutionizing Accounting

- Key Technologies Behind IoT in Accounting

- Benefits of IoT in Accounting Systems

- Challenges and Risks Associated with IoT Adoption in Accounting

- IoT Use Cases in Accounting

- Role of AI and Machine Learning in IoT Accounting Systems

- How IoT App Development Companies Are Transforming Accounting

- Future Trends in IoT and AI in Accounting

- Why Choose HashStudioz for IoT in Accounting Solutions?

- How HashStudioz Helps You Evolve Your Accounting Systems

- Conclusion

- FAQs

Understanding IoT in Accounting

The Internet of Things (IoT) is a network of interconnected devices that gather, process, and exchange data through the internet. In accounting, IoT leverages these devices to automate financial tasks, streamline operations, and improve decision-making processes.

IoT in Accounting transforms traditional accounting systems by integrating smart technologies with financial tools, enabling real-time data collection and processing.

Key Applications of IoT in Accounting:

1. Smart Sensors for Inventory Management – Track stock levels and updates automatically, reducing manual oversight.

2. RFID Tags for Asset Tracking – Monitor physical assets, ensuring accurate valuation and depreciation tracking.

3. Mobile Devices for Real-Time Reporting – Enable instant updates and remote access to financial records.

4. Cloud Platforms for Data Storage and Accessibility – Provide secure storage and easy retrieval of financial data.

Key Benefits of IoT in Accounting:

1. Automation of Repetitive Tasks – Reduces manual data entry errors.

2. Transparency and Compliance – Ensures audit-ready records and improves regulatory compliance.

3. Cost Efficiency – Optimizes operations and reduces administrative overhead.

4. Enhanced Decision-Making – Real-time analytics enable proactive financial strategies.

IoT-enabled accounting systems empower businesses to move beyond spreadsheets and embrace smart systems for improved efficiency and accuracy.

The Transition: From Spreadsheets to Smart Systems

Traditional Spreadsheets and Manual Processes:

- Relied heavily on manual data entry and formulas.

- Prone to errors, duplication, and version control issues.

- Limited scalability as businesses expanded.

Limitations of Spreadsheets:

- Inability to handle large volumes of financial data.

- Lack of real-time updates for decision-making.

- Dependence on human input led to inconsistencies and time delays.

The Need for Smart Systems:

- Businesses faced challenges with data complexity and compliance regulations.

- Rising demand for automation and data security required a technological shift.

Emergence of IoT Smart Systems:

- IoT in Accounting integrates real-time data from multiple sources like inventory trackers, payment systems, and expense trackers.

- Automation minimizes manual errors and speeds up processes.

- Provides scalable solutions for growing data needs.

Key Advantages of Smart Systems Over Spreadsheets:

- Real-time Data Collection: Immediate updates from connected devices.

- Enhanced Accuracy: Reduced human intervention eliminates errors.

- Improved Analytics: AI and machine learning services analyze data patterns for insights.

- Transparency and Compliance: Tracks transactions and ensures audit readiness.

Impact on Modern Accounting:

- Smart systems make accounting dynamic, transparent, and error-free.

- Businesses gain predictive analytics and decision-making support through AI and IoT technologies.

The Evolution of Accounting Systems

Accounting systems have evolved through several stages, adapting to technological advancements for improved accuracy, efficiency, and accessibility. Here’s a detailed overview:

Paper-Based Accounting

- Early accounting practices relied on manual bookkeeping using physical ledgers and journals.

- These methods were time-consuming, error-prone, and difficult to scale as businesses grew.

- Tracking financial records required extensive manual labor, leading to inefficiencies.

Spreadsheets and Accounting Software

- The introduction of spreadsheet tools like Microsoft Excel and accounting software automated calculations, reducing human errors.

- These tools streamlined processes like data entry, payroll management, and budgeting.

- However, they still required human oversight and lacked real-time updates, limiting scalability.

Cloud-Based Accounting Software

- With the advent of cloud technology, accounting shifted to real-time data storage and sharing.

- Cloud-based systems enabled remote access, multi-user collaboration, and automatic backups, ensuring data security.

- Businesses gained scalability and flexibility, making accounting processes more collaborative and responsive.

IoT-Enabled Smart Systems

- Modern accounting systems integrate IoT devices with AI and Machine Learning Services to automate processes.

- These smart systems provide real-time data collection, predictive analytics, and error-free processing, reducing manual intervention.

- IoT-enabled accounting streamlines expense tracking, audits, and compliance for smarter decision-making.

AI and Machine Learning-Powered Accounting

- Advanced Artificial Intelligence Services and Machine Learning algorithms have further enhanced accounting systems.

- AI can detect anomalies, forecast financial trends, and analyze large datasets for strategic decision-making.

- Machine learning systems continuously learn and adapt, improving accuracy and efficiency in fraud detection, tax management, and financial reporting.

- These technologies reduce human dependency, enabling proactive financial management and compliance monitoring.

How IoT is Revolutionizing Accounting

The integration of IoT in Accounting is transforming financial management by enabling automation, improving accuracy, and providing real-time insights. IoT devices, including smart sensors and interconnected systems, help streamline operations, enhance compliance, and simplify complex accounting processes.

Real-Time Data Collection and Processing

IoT devices enable continuous monitoring and recording of financial transactions. These systems provide real-time data collection to ensure records are always accurate and up-to-date. Key benefits include:

- Instant Data Access – Transactions are logged immediately, reducing delays.

- Error-Free Reporting – Automated data collection minimizes human errors.

- Faster Decision-Making – Access to live data enables quick responses to financial issues.

Automation of Financial Transactions

IoT simplifies accounting workflows by automating repetitive tasks, reducing manual input. This includes:

- Invoice Management – Automatically matching invoices with purchase orders and processing payments.

- Payroll and Taxes – Accurate salary computation and real-time tax adjustments based on updated regulations.

- Expense Tracking – Monitoring expenses through IoT-connected payment systems for easier reconciliation.

Enhanced Accuracy and Compliance

IoT systems improve financial accuracy and simplify compliance management. Businesses benefit from:

- Automated Updates – Systems adjust to new tax laws and compliance standards.

- Audit-Ready Reports – Transaction logs are detailed and accessible for audits.

- Regulatory Monitoring – IoT devices track compliance metrics to avoid fines and penalties.

Predictive Analytics for Financial Planning

IoT, combined with AI in Accounting and Machine Learning Services, enables predictive analytics to forecast trends and optimize budgeting. Key applications include:

- Cash Flow Predictions – Analyzing patterns to project future cash flows.

- Risk Assessment – Identifying potential financial risks based on historical data.

- Investment Strategies – Providing data-driven insights to guide investment decisions.

Fraud Detection and Security Enhancements

IoT systems add an extra layer of security by detecting unusual patterns and transactions in real time. These smart systems:

- Monitor Transactions – Flag anomalies or suspicious activities for review.

- Secure Data Transmission – Use encrypted communication to protect sensitive information.

- Automated Alerts – Notify administrators instantly about potential fraud attempts.

Key Technologies Behind IoT in Accounting

1. Artificial Intelligence and Machine Learning: AI and Machine Learning Services analyze financial data to identify trends, detect anomalies, and predict outcomes, enhancing accuracy and automating processes in accounting.

2. Cloud Computing and IoT Integration: Cloud platforms store and process IoT data, ensuring scalability and accessibility for businesses to manage financial data securely in real time.

3. Mobile App Development and IoT Platforms: Mobile App Development Companies create custom applications that enable accountants to access IoT data on-the-go, improving productivity and decision-making.

4. Big Data Analytics in IoT for Accounting: Big Data Analytics helps businesses gain insights from vast IoT data, enabling better forecasting, budgeting, and strategic decision-making.

5. Blockchain Technology for Secure Financial Transactions: Blockchain ensures secure, transparent, and immutable financial transactions, reducing fraud risks and improving accountability in IoT-based accounting systems.

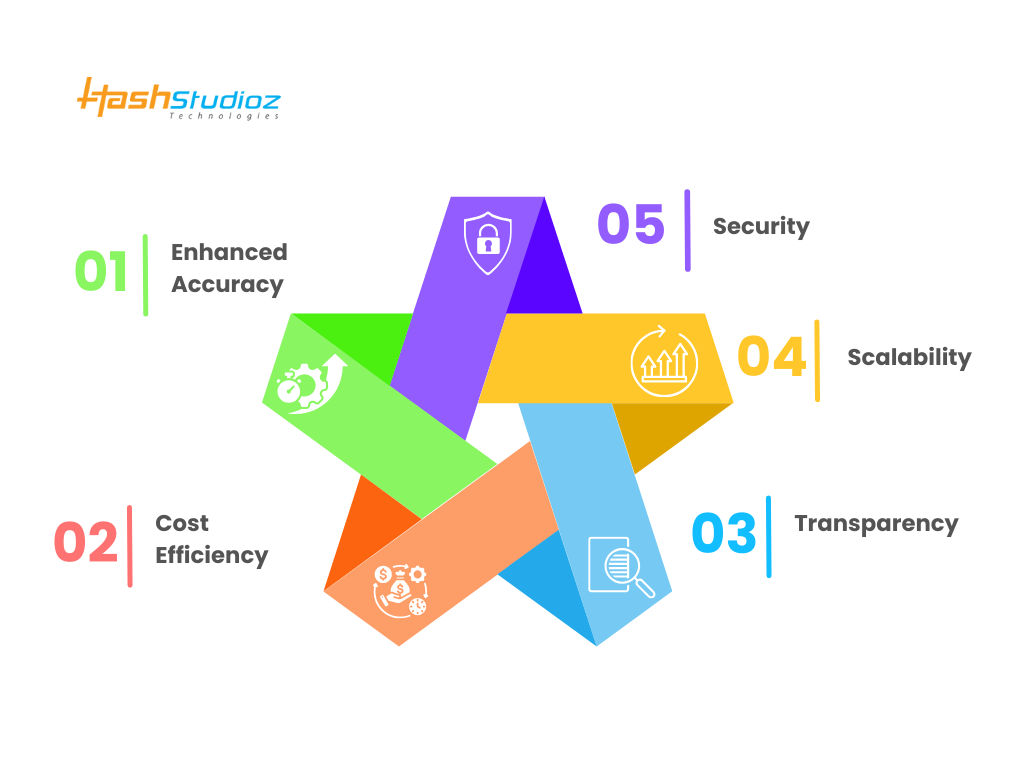

Benefits of IoT in Accounting Systems

1. Enhanced Accuracy: IoT in accounting systems automates data collection and entry, significantly reducing the risk of human errors in financial records, ensuring more accurate and reliable data.

2. Cost Efficiency: By automating repetitive tasks and optimizing workflows, IoT minimizes manual labor and reduces the time spent on accounting processes, leading to lower operational costs.

3. Transparency: IoT-enabled systems provide real-time data, giving businesses a clear view of financial activities and helping to ensure transparency in transactions and reporting.

4. Scalability: IoT solutions can easily scale to accommodate growing business needs, such as handling increased transaction volumes or expanding into new markets without significant system overhauls.

5. Security: IoT in accounting uses encryption and secure data connections to protect sensitive financial information, ensuring data integrity and compliance with privacy regulations.

Challenges and Risks Associated with IoT Adoption in Accounting

1. Cybersecurity Threats: IoT networks are vulnerable to cyberattacks if not properly secured, exposing sensitive financial data to potential breaches or unauthorized access.

2. Integration Complexities: Integrating IoT devices with legacy accounting systems can be technically challenging and resource-intensive, requiring significant adjustments to existing infrastructure.

3. Data Overload: The large volumes of real-time data generated by IoT devices can overwhelm traditional data systems, requiring advanced tools and analytics to manage and extract actionable insights.

4. Regulatory Compliance: Ensuring IoT systems comply with data protection laws, such as GDPR or HIPAA, can be complex, requiring continuous updates to meet evolving regulatory requirements.

5. Cost of Implementation: The upfront investment in IoT hardware, software, and skilled personnel, along with ongoing maintenance costs, can strain financial resources, particularly for small and medium-sized businesses.

IoT Use Cases in Accounting

1. Expense Management: IoT expense trackers monitor spending, generate reports, and alert managers to anomalies, ensuring better financial control and accuracy.

2. Asset Tracking and Inventory Management: RFID tags and GPS trackers track assets and inventory in real time, preventing loss, theft, and mismanagement.

3. Fraud Detection and Prevention: AI algorithms analyze transaction patterns to detect suspicious activities, enhancing security and minimizing financial fraud.

4. Automated Invoice Processing: IoT automates invoice creation and processing by integrating with accounting software, reducing manual effort, improving accuracy, and speeding up billing cycles.

5. Real-time Financial Reporting : IoT systems generate real-time financial reports by collecting data from various sources, providing up-to-date insights for quick decision-making and improved transparency.

Role of AI and Machine Learning in IoT Accounting Systems

AI and Machine Learning Services enhance IoT accounting systems by adding advanced analytical capabilities. Here’s how they contribute:

1. Data Processing: AI automates the analysis of large volumes of financial data collected by IoT devices, speeding up processing and reducing human error.

2. Predictive Analytics: AI helps forecast financial trends, predict cash flows, and generate insights that assist in budgeting and decision-making.

3. Anomaly Detection: Machine Learning algorithms learn from historical financial data and can automatically identify unusual transactions, flagging potential fraud or errors in real-time.

4. Process Optimization: Machine Learning continuously improves accounting processes by analyzing patterns and suggesting more efficient workflows.

5. Automation of Routine Tasks: AI automates repetitive tasks like invoice generation and expense tracking, freeing up time for more strategic financial management.

How IoT App Development Companies Are Transforming Accounting

IoT App Development Companies are playing a crucial role in transforming accounting processes by offering innovative, customized solutions. Below are the key ways these companies are driving change:

1. Seamless Integration of IoT Devices: IoT App Development Companies design platforms that seamlessly integrate IoT devices with accounting systems, allowing businesses to automate and optimize their financial processes.

2. Real-Time Data Monitoring and Management: These platforms enable businesses to track and manage accounting data in real time, ensuring that financial records are always up-to-date and accurate.

3. Automated Data Collection: IoT devices such as sensors and smart meters collect data automatically, reducing the need for manual data entry and minimizing human errors in accounting.

4. Improved Expense Tracking: IoT-enabled solutions help businesses track expenses, such as fuel usage, inventory levels, and utility consumption, providing detailed insights for budgeting and forecasting.

5. Enhanced Financial Accuracy: By automating data entry and providing real-time updates, IoT applications reduce inaccuracies and discrepancies in financial records.

6. Streamlined Invoicing and Payments: IoT platforms can automatically generate invoices and monitor payment statuses, ensuring faster and more accurate billing processes.

7. Optimized Decision-Making: With comprehensive and up-to-date financial data at their fingertips, businesses can make more informed decisions, improving overall financial planning and performance.

8. Cost and Time Efficiency: By reducing manual processes and administrative workload, IoT solutions save time and money, allowing accounting teams to focus on strategic tasks.

Future Trends in IoT and AI in Accounting

1. Blockchain Integration: Blockchain enhances transparency and security by providing a decentralized ledger that ensures all financial transactions are verifiable, reducing fraud risks and increasing trust in accounting systems.

2. Predictive Analytics: AI-powered predictive analytics helps businesses forecast future financial trends, enabling more accurate budgeting, risk management, and decision-making.

3. Voice-Activated Accounting Systems: Voice-activated systems streamline accounting tasks by allowing hands-free operations, improving efficiency and reducing errors in tasks like invoicing and data retrieval.

4. Robotic Process Automation (RPA) in Accounting: RPA automates repetitive accounting tasks such as data entry and invoice processing, improving efficiency, reducing human error, and freeing up accountants for more strategic work.

5. Real-Time Financial Monitoring: IoT devices enable real-time financial tracking, while AI analyzes the data to provide instant insights, improving decision-making and financial oversight.

Why Choose HashStudioz for IoT in Accounting Solutions?

| Reason | How HashStudioz Helps |

| Expertise in IoT & AI | HashStudioz integrates IoT and AI seamlessly to enhance efficiency and data accuracy. |

| Customized Solutions | They provide bespoke IoT solutions tailored to your specific accounting needs. |

| End-to-End Support | From consultation to system integration and maintenance, HashStudioz offers comprehensive services. |

| Security & Compliance | Ensures data security and compliance with industry regulations in your IoT accounting system. |

| Scalable Solutions | Provides scalable solutions that grow with your business needs. |

How HashStudioz Helps You Evolve Your Accounting Systems

| Service | Benefit |

| IoT Integration | Automates data collection and reduces manual entry, improving workflow. |

| Real-Time Data Accuracy | Ensures up-to-date financial data for faster decision-making. |

| Predictive Analytics | Uses AI to forecast financial trends, optimizing financial planning. |

| Automation of Routine Tasks | Automates invoicing, expense tracking, and reconciliation for efficiency. |

| Mobile App Solutions | Custom mobile apps for on-the-go access to accounting data. |

HashStudioz helps businesses transition from traditional systems to advanced IoT-enabled accounting solutions, driving efficiency, security, and growth.

Conclusion

The integration of IoT in Accounting has redefined traditional financial practices, transforming them into smart, automated systems. With advancements in AI in Accounting, businesses can now make data-driven decisions, improve compliance, and enhance operational efficiency. Leveraging services from a Mobile App Development Company or an IoT App Development Company ensures seamless adoption and scalability. As technology evolves, accounting systems will continue to become more intelligent, secure, and adaptable.

FAQs

1. What is IoT in Accounting?

IoT in accounting refers to using interconnected devices to collect, process, and analyze financial data in real-time, improving efficiency and accuracy.

2. How does AI in Accounting work?

AI uses algorithms and machine learning to automate tasks, detect patterns, and provide predictive insights, making accounting smarter.

3. What are the challenges of adopting IoT in accounting?

Key challenges include cybersecurity risks, integration issues, and managing large data volumes.

4. Why hire an IoT App Development Company?

These companies provide tailored solutions to integrate IoT into accounting systems, ensuring seamless implementation and scalability.

5. How does IoT improve compliance?

IoT systems automate data tracking and reporting, ensuring accuracy and compliance with regulatory standards.