Risk management is the cornerstone of every business’s ability to survive and thrive in a world filled with uncertainties. From financial downturns and cybersecurity breaches to operational disruptions, risks can arise from numerous sources. In 2023, cybersecurity threats alone cost businesses over $6 trillion globally, while operational disruptions accounted for an average loss of $260,000 per hour for enterprises. While traditional methods have played a crucial role, the advent of Artificial Intelligence (AI) has revolutionized how businesses approach risk management, with AI-driven tools improving risk detection accuracy by up to 90% and reducing response times by 40% or more.

Table of Contents

- What is Risk Management?

- Traditional Risk Management: The Old Guard’s Limitations

- The Rise of AI in Risk Management

- Applications of AI in Risk Management

- How AI Improves Risk Management Strategies

- Benefits of AI in Risk Management

- Challenges in Implementing AI for Risk Management

- Real-World Examples of AI in Action

- Key Statistics Supporting AI Adoption in Risk Management

- Best Practices for AI Integration in Risk Management

- Future Trends in AI for Risk Management

- Revolutionizing Risk Management with AI: How HashStudioz Drives Data-Driven Success

- Conclusion

- FAQ: AI in Risk Management

What is Risk Management?

Risk management involves the process of identifying, analyzing, and mitigating uncertainties that can negatively affect an organization’s operations or objectives. These risks may range from financial losses and legal liabilities to market volatility and cybersecurity threats. Effective risk management not only minimizes potential losses but also enhances decision-making and operational efficiency.

Traditional Risk Management: The Old Guard’s Limitations

Traditional risk management relies heavily on manual assessments, human judgment, and historical data. While these methods have been effective for decades, they struggle to keep pace with the increasing complexity of modern risks. Here’s why:

- Limited Scalability: Traditional approaches can’t handle the massive volumes of data generated in today’s digital economy.

- Delayed Insights: Manual processes often lead to delays in identifying and mitigating risks.

- Human Bias: Risk assessments may be influenced by subjective judgments or oversight, leading to inaccurate outcomes.

- Static Models: Traditional models are based on past data and fail to adapt to rapidly changing risk landscapes.

With these limitations, organizations are turning to advanced technologies like AI to enhance their risk management frameworks.

The Rise of AI in Risk Management

Artificial Intelligence in Risk Management refers to the use of machine learning, data analytics, and automation to identify, assess, and mitigate risks more efficiently. AI’s ability to process vast amounts of data and identify patterns makes it a game-changer for risk management professionals.

AI in Mental Health: Exploring the Future of Digital Therapy

Applications of AI in Risk Management

AI has found numerous applications across various industries, significantly enhancing their ability to manage risks. Below are some of the key areas where AI is making a difference:

1. Fraud Detection and Prevention

AI-powered algorithms analyze transaction data in real time, identifying suspicious activities and flagging potential fraud. This is particularly beneficial for financial institutions dealing with high volumes of transactions.

- Example: AI can detect unusual spending patterns on credit cards and alert users instantly.

2. Cybersecurity and Threat Detection

With the rise in cyberattacks, AI plays a critical role in identifying vulnerabilities and preventing breaches. AI systems can analyze network traffic, detect anomalies, and respond to threats faster than traditional methods.

- Example: AI-driven security tools like IBM’s Watson are used to predict and mitigate cyber risks.

3. Predictive Analytics in Financial Risks

Financial institutions leverage AI to predict market trends and assess credit risks. AI models can evaluate customer data, economic indicators, and financial history to provide accurate risk scores.

- Stat: A report by PwC states that 77% of banks are leveraging AI for risk management, especially in areas like credit assessment.

4. Regulatory Compliance

AI ensures compliance by analyzing legal documents, monitoring regulatory updates, and automating compliance reporting. This helps organizations avoid penalties and reputational damage.

- Example: AI tools can scan contracts for compliance issues and suggest corrections in real time.

5. Supply Chain Risk Management

AI optimizes supply chains by predicting potential disruptions, monitoring supplier reliability, and managing inventory levels.

- Example: Companies like DHL use AI to improve logistics planning and reduce delivery risks.

How AI Improves Risk Management Strategies

AI’s integration into risk management brings transformative changes. Here’s how:

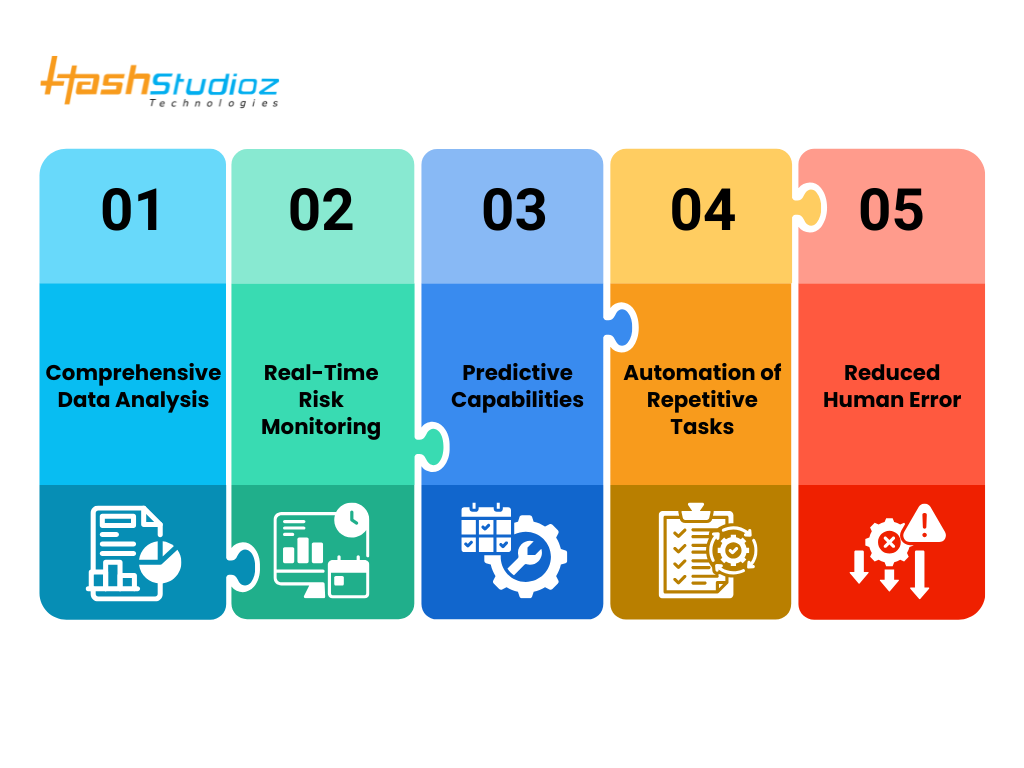

1. Comprehensive Data Analysis

AI processes massive datasets from diverse sources, uncovering hidden patterns and correlations. This enhances the accuracy and depth of risk assessments.

2. Real-Time Risk Monitoring

AI systems continuously monitor risks, providing instant alerts for potential threats. This allows organizations to respond promptly and reduce exposure.

- Example: AI monitors online transactions in real time to detect fraud, saving businesses millions annually.

3. Predictive Capabilities

AI uses predictive analytics to anticipate future risks based on historical data. This enables businesses to prepare for potential challenges effectively.

4. Automation of Repetitive Tasks

AI automates routine tasks like data entry and risk reporting, freeing up human resources for strategic decision-making.

5. Reduced Human Error

By eliminating manual intervention in critical processes, AI minimizes the likelihood of errors that could lead to significant losses.

Benefits of AI in Risk Management

The adoption of AI in risk management offers numerous advantages that extend beyond efficiency. Here are the top benefits:

1. Enhanced Decision-Making

AI provides actionable insights, empowering leaders to make informed decisions quickly.

2. Improved Cost Efficiency

By identifying and mitigating risks proactively, AI helps organizations avoid costly disruptions and losses.

3. Greater Risk Visibility

AI offers a 360-degree view of potential risks, enabling comprehensive risk management strategies.

4. Faster Response Times

AI systems can detect and respond to threats in milliseconds, reducing the impact of risks.

5. Scalability

AI solutions are highly scalable, making them suitable for organizations of all sizes and across industries.

Challenges in Implementing AI for Risk Management

Despite its advantages, integrating AI into risk management comes with challenges that organizations must address:

1. Data Quality and Availability

AI models rely on high-quality, well-structured data. Incomplete or biased data can lead to inaccurate outcomes.

2. Implementation Costs

The initial investment in AI systems, including infrastructure and expertise, can be significant.

3. Ethical and Legal Concerns

AI raises questions about data privacy, security, and regulatory compliance, which must be carefully managed.

4. Lack of Expertise

Deploying AI systems requires skilled professionals, which may not be readily available in all organizations.

5. Algorithmic Bias

AI systems can inherit biases from the data they are trained on, leading to skewed risk predictions.

AI in Asset Management: A Step-by-Step Guide to Automating Your Investment Strategy

Real-World Examples of AI in Action

1. Financial Sector

Leading banks use AI to monitor transactions and detect fraudulent activities in real time. For instance, HSBC employs AI for anti-money laundering efforts.

2. Healthcare

AI predicts patient health risks, such as the likelihood of readmission or adverse drug reactions, improving patient care outcomes.

3. Insurance

Insurers use AI to assess claims, detect fraud, and personalize premiums based on risk profiles.

4. Retail

Retailers utilize AI to manage supply chain risks, predict demand fluctuations, and ensure timely delivery.

Key Statistics Supporting AI Adoption in Risk Management

- The global AI market in risk management is expected to grow from $4.6 billion in 2021 to $14.9 billion by 2028, at a CAGR of 18.2%.

- Businesses using AI for risk management report a 25-35% reduction in operational risks.

- 70% of CEOs believe AI will be a key driver for reducing costs in the next five years.

Best Practices for AI Integration in Risk Management

To maximize the benefits of AI, organizations should follow these best practices:

1. Define Clear Objectives: Identify the specific risks AI will address, such as cybersecurity or financial risks.

2. Ensure Data Quality: Invest in high-quality data sources to train AI models effectively.

3. Collaborate with Experts: Work with AI specialists and risk management professionals to design robust systems.

4. Start Small: Pilot AI solutions on a small scale before full implementation.

5. Monitor Continuously: Regularly evaluate AI systems to ensure accuracy, compliance, and adaptability.

Future Trends in AI for Risk Management

The future of AI in Risk Management is promising, with exciting advancements on the horizon:

- Explainable AI (XAI): Enhancing transparency by making AI decision-making processes understandable.

- AI-Powered Risk Dashboards: Centralized platforms offering real-time risk insights for better decision-making.

- Edge Computing: Enabling faster risk analysis by processing data closer to its source.

- AI-Augmented Collaboration Tools: Facilitating better communication and decision-making across risk management teams.

Revolutionizing Risk Management with AI: How HashStudioz Drives Data-Driven Success

At HashStudioz Technology, we are committed to helping businesses tackle challenges and seize opportunities through innovation. Our expertise in Artificial Intelligence (AI) empowers organizations to revolutionize risk management and enhance decision-making. Risk management has grown beyond traditional methods, and businesses need smarter, data-driven approaches to stay resilient in today’s unpredictable environment. That’s where we step in.

Our Core Services at HashStudioz Technology

1. Artificial Intelligence and Machine Learning:

Develop intelligent systems that analyze data, predict risks, and support decision-making.

2. Internet of Things (IoT):

Create connected ecosystems for real-time monitoring and smarter risk detection.

3. Blockchain Solutions:

Ensure secure and transparent operations with advanced blockchain technology.

4. Salesforce Development Services:

Optimize your business processes with customized Salesforce CRM solutions.

5. Cloud Computing:

Enhance operational efficiency with scalable cloud-based services.

6. E-Commerce and Marketplace Development:

Build robust platforms to expand your business reach and customer engagement.

7. Travel Technology Solutions:

Streamline travel operations with cutting-edge tools and integrations.

8. Robotics:

Automate and innovate with robotics for industries like manufacturing and healthcare.

9. Cybersecurity:

Protect your digital assets and data with top-notch security solutions.

10. AI-Powered Risk Management Systems:

Transform your risk management approach with data-driven strategies that leverage AI.

Conclusion

AI in Risk Management is no longer a luxury but a necessity for businesses navigating today’s complex risk landscapes. By offering unparalleled data analysis, predictive capabilities, and automation, AI empowers organizations to stay ahead of potential threats. Despite challenges like data privacy and high implementation costs, the benefits of adopting AI far outweigh the drawbacks.

As industries embrace AI-driven risk management, those that fail to adapt risk falling behind. Organizations that integrate Artificial Intelligence into their risk management frameworks will not only safeguard their operations but also position themselves for sustainable success in an unpredictable future.

FAQ: AI in Risk Management

1. What is AI in Risk Management?

AI in risk management refers to the use of artificial intelligence technologies, such as machine learning, predictive analytics, and automation, to identify, assess, and mitigate risks more efficiently. It involves analyzing vast amounts of data to detect patterns and predict potential threats in real time.

2. Why is AI important in risk management?

AI is crucial because it improves the accuracy and speed of risk assessments. It allows organizations to handle large volumes of data, provides predictive insights, reduces human error, and offers real-time monitoring, enabling faster responses to emerging risks.

3. How does AI detect fraud?

AI detects fraud by analyzing transaction data in real time to identify anomalies or suspicious activities. For example, machine learning models can spot unusual spending patterns, flagging transactions that deviate from typical behavior.

4. How does AI enhance decision-making in risk management?

AI provides actionable insights by processing and analyzing complex datasets that humans might overlook. It identifies trends, correlations, and risks, offering precise recommendations that support better decision-making.

5. Can AI replace human expertise in risk management?

No, AI cannot entirely replace human expertise. While AI excels at data analysis and automation, human judgment is essential for interpreting results, making ethical decisions, and addressing unique or unprecedented situations.

6. What is predictive analytics in AI-driven risk management?

Predictive analytics uses AI to analyze historical and real-time data to forecast potential risks or events. It helps organizations prepare for future challenges by identifying trends and patterns that indicate likely outcomes.