The banking industry is evolving faster than ever. Customers now expect quick services, digital access, and personalized support. At the same time, banks must meet strict regulations, cut operating costs, and stay ahead of growing competition.

Traditional CRM systems struggle to keep up with this new reality. They are often expensive, rigid, and not designed for banking-specific needs. The result is slower processes, fragmented data, and a poor customer experience.

To remain competitive, banks are shifting toward digital-first solutions. Odoo-powered banking CRM stands out as a flexible and affordable option that supports complex financial operations. It helps banks streamline workflows, manage compliance, and strengthen customer relationships in a simple and scalable way.

Table of Contents

Why Odoo for Banking CRM?

Banks and financial institutions need a CRM that can handle large data, strict compliance rules, and fast-changing customer demands. Odoo stands out as a practical choice for these needs.

1. Flexibility and scalability

Odoo is open-source and modular, which means banks can start with basic features and add more as they grow. From customer onboarding to loan tracking, every process can be customized without heavy investment. This flexibility ensures the system adapts to the bank, not the other way around.

2. Cost-effectiveness vs. enterprise CRMs

Popular platforms like Salesforce or Microsoft Dynamics are powerful but often expensive to license, implement, and maintain. Odoo offers similar functionality at a lower cost, making it suitable for banks, NBFCs, and credit unions that want enterprise-level performance without high recurring fees.

3. Integration with core banking and compliance systems

Odoo integrates smoothly with core banking systems, ERPs, and third-party apps. It also supports compliance workflows like KYC, AML, and GDPR, helping banks reduce errors and stay aligned with regulations. With real-time data syncing, teams can work faster and serve customers better.

Key Features of Odoo-Powered Banking CRM

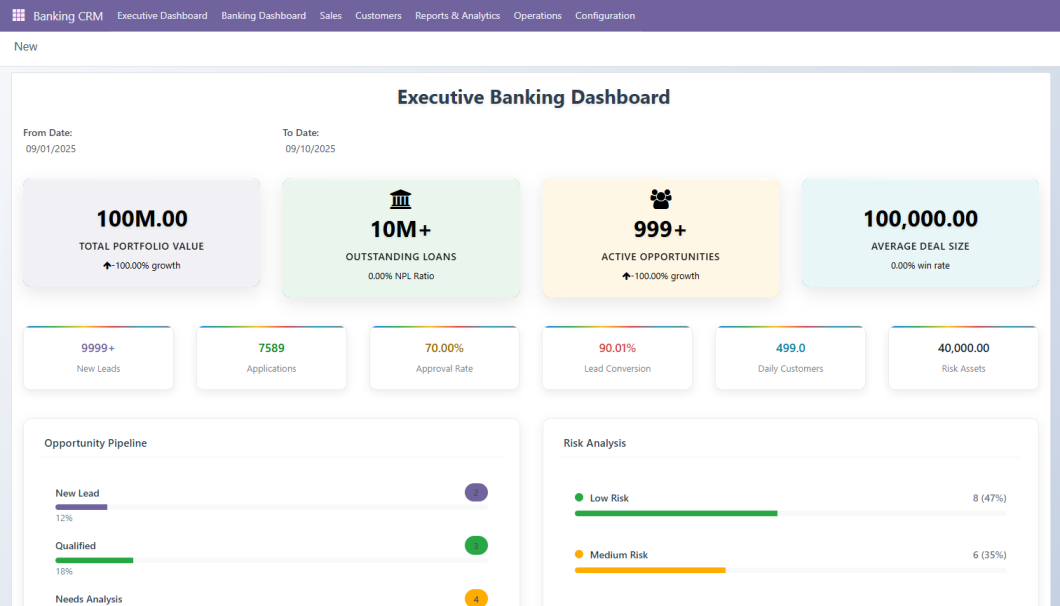

1. Centralized Banking Dashboard

- View total opportunities, leads, loan applications, and won deals in one place.

- Track pipeline value, conversion rates, and approval rates in real time.

- Quick action buttons for faster deal and loan management.

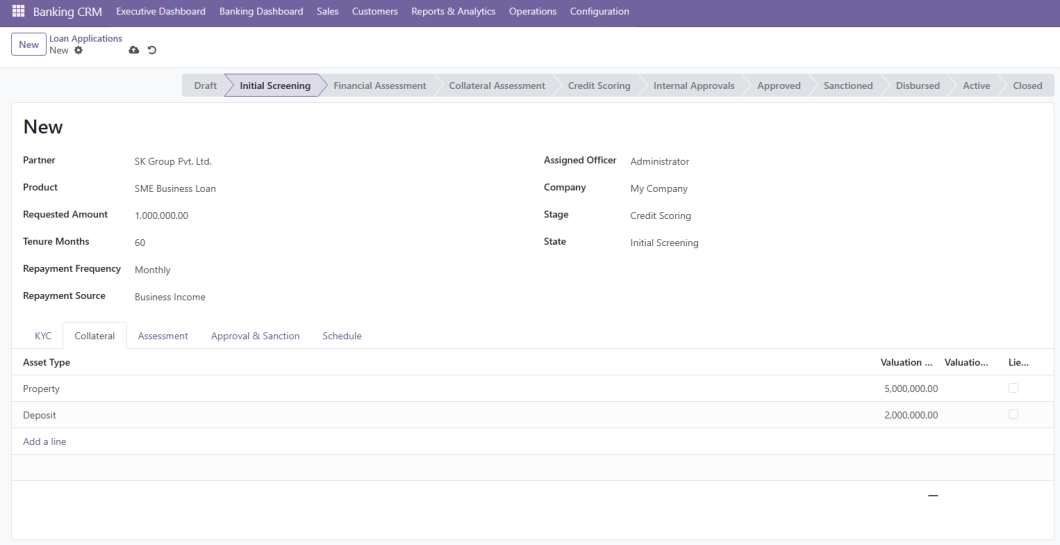

2. Loan Application Management

- End-to-end loan tracking from financial assessment to disbursement.

- Personalized workflows for different loan types.

- Reduce manual errors and speed up approval cycles.

3. Advanced Reports & Analytics

- Dashboards for opportunities, loans, leads, and portfolio performance.

- In-depth risk, compliance, and regulatory reports.

- Data-driven decisions with visual insights.

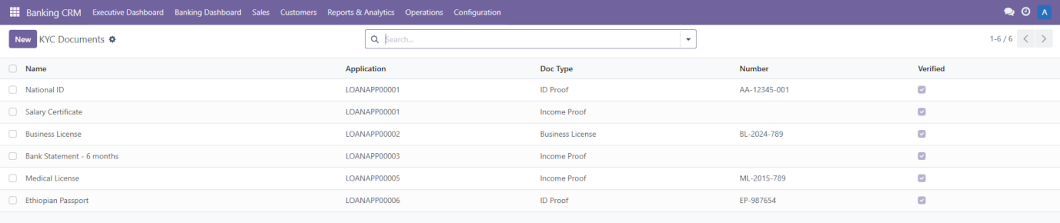

4. KYC & Compliance Automation

- Secure storage and verification of KYC documents.

- Integrated workflows for income proof, ID proof, and licenses.

- Helps banks meet regulatory standards with ease.

5. Customer & Sales Management

- Maintain a single view of customer profiles and transactions.

- Track sales performance and product success.

- Simplify relationship management with history-based insights.

6. Operations & Collateral Management

- Manage collaterals linked to loan applications.

- Transaction tracking for transparency and accuracy.

- Streamlined operations reduce delays in banking processes.

Benefits of Odoo Banking CRM

Adopting Odoo for banking CRM is not just about technology. It is about creating real value for both banks and their customers.

1. Benefits for Banks

- Improved Efficiency: Automated workflows reduce manual paperwork and speed up processes like loan approvals and KYC checks.

- Better Compliance: Built-in document tracking and audit trails make it easier to follow regulatory requirements.

- Cost Reduction: Centralized data lowers operational costs by minimizing duplication and errors.

- Actionable Insights: Advanced analytics help decision-makers track loan performance, customer behavior, and portfolio health.

- Scalability: The modular design lets banks add new features as they grow, without major system overhauls.

2. Benefits for Customers

- Faster Approvals: Quick verification and loan processing save customers valuable time.

- Personalized Banking: Tailored recommendations and services create a better customer experience.

- Transparent Communication: Customers can easily track application status and interact with the bank.

- Trust and Security: Verified KYC and compliance measures ensure safe transactions.

- Seamless Experience: From lead to disbursement, customers enjoy a smooth and consistent journey.

Implementation Considerations for Odoo Banking CRM

- Migration from Legacy Systems

Data must be transferred securely and in compliance with regulations. Odoo supports integration with existing databases, but careful mapping and validation are needed to avoid errors. - Customization Strategy

Odoo’s modular design allows banks to tailor workflows like loan processing and KYC. Over-customization, however, can create maintenance challenges and slow down updates. - Staff Training and Adoption

A CRM is only as effective as the people using it. Structured training, clear documentation, and change management help employees adapt quickly and use the system to its full potential. - Compliance and Security Setup

Banks should configure role-based access, encryption, and audit trails from the start. This ensures sensitive data is protected and regulatory requirements are met. - System Integration

Odoo must connect with core banking systems, ERPs, payment gateways, and reporting platforms. Proper integration enables real-time data syncing and accurate decision-making.

Future Trends and Innovations in Banking CRM

Banking CRM is moving toward AI-powered insights that help banks predict customer needs and improve portfolio management. With machine learning models built into the system, relationship managers can make data-driven recommendations and reduce risk in lending decisions.

Mobile-first banking is another key trend. Customers want instant access to services, and CRMs that extend seamlessly to mobile apps create smoother experiences. From tracking loan applications to verifying KYC, mobile integration will continue to grow in importance.

Omnichannel support is also shaping the future. Customers interact with banks through branches, apps, emails, and chatbots. A modern CRM must connect these channels into a single view, ensuring consistent communication and faster resolutions.

Together, these trends show that CRMs will no longer just manage data. They will actively drive customer engagement, compliance, and operational efficiency in the years ahead.

Why Choose HashStudioz for Odoo Banking CRM Implementation?

At HashStudioz, we specialize in building custom Odoo-powered banking CRM solutions that help banks modernize and grow.

Our experts deliver:

- Tailored CRM customization for banking-specific workflows.

- Seamless integrations with core banking, ERPs, and compliance systems.

- Secure and compliant deployments aligned with KYC, AML, and GDPR.

- Training and support to maximize adoption and efficiency.

Whether you’re a bank, NBFC, or credit union, HashStudioz ensures your CRM transformation is smooth, cost-effective, and future-ready.

Conclusion

The future of banking depends on digital-first systems that balance compliance, efficiency, and customer experience. Odoo-powered banking CRM offers banks a practical way to achieve this with flexibility, affordability, and scale. By streamlining operations and creating personalized journeys, it helps financial institutions stay competitive in a fast-changing market.

Now is the time for banks to move beyond rigid legacy CRMs and embrace a solution that grows with their business. Odoo provides the foundation to deliver smarter banking and stronger customer relationships.er smarter banking and stronger customer relationships.