Options trading involves complex strategies like spreads, straddles, and iron condors. U.S. traders face constant pressure to execute trades quickly while managing risk. Human error—such as mis-clicks or emotional decision-making—can cost thousands. Personalized automated options trading bots offer precise, disciplined execution. They can reduce mistakes and lower trading risks.

Table of Contents

- What Is a Personalized Automated Options Trading Bot?

- Why Human Error Occurs in Options Trading

- How Bots Reduce Human Error

- Why Personalization Matters

- Key Technical Components of a Bot

- Risk Reduction with Real Statistics

- Examples of Error Avoidance

- Why U.S.-Based Development Adds Value

- How to Evaluate an Options Trading Bot Development Company in USA

- Why Choose HashStudioz for Options Trading Bot Development

- Conclusion

What Is a Personalized Automated Options Trading Bot?

A personalized automated options trading bot is a software system tailored to a trader’s strategy. It uses code to scan markets, place orders, monitor positions, and manage risk 24/7. Developers build bots based on specific rules—entry triggers, stop losses, profit targets, chain selection, and scaling size. Personalization allows traders to embed unique strategy preferences into the bot. That prevents generic behavior and supports consistent application of strategy.

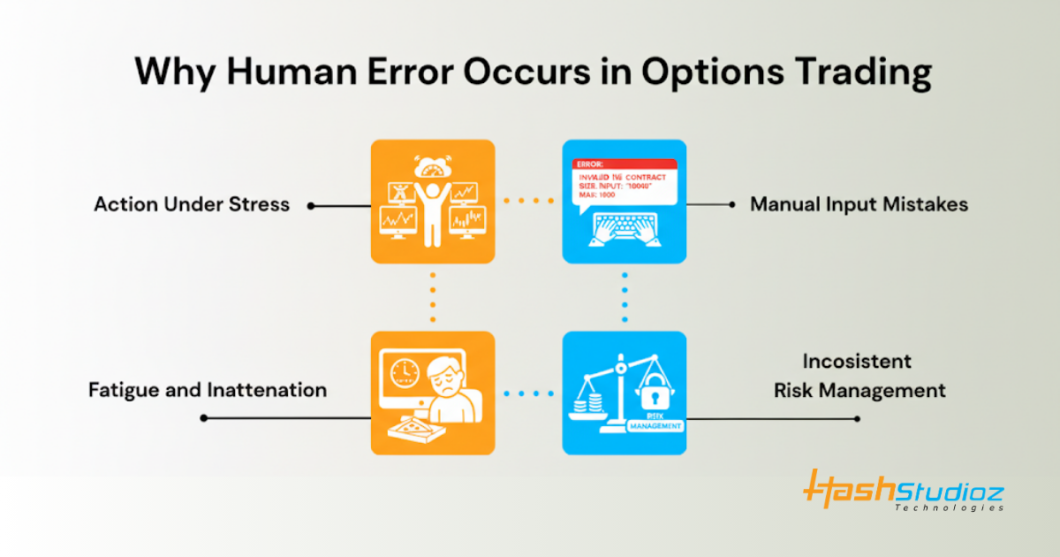

Why Human Error Occurs in Options Trading

1. Action Under Stress

Traders react emotionally when markets move fast. Panic or greed can trigger impulsive trades.

2. Manual Input Mistakes

Typing the wrong option strike or expiration can cause large unintended losses.

3. Fatigue and Inattention

Long trading sessions create fatigue. Mistakes grow as focus drops.

4. Inconsistent Risk Management

Humans often shift position sizes or bypass stop rules due to bias or second-guessing.

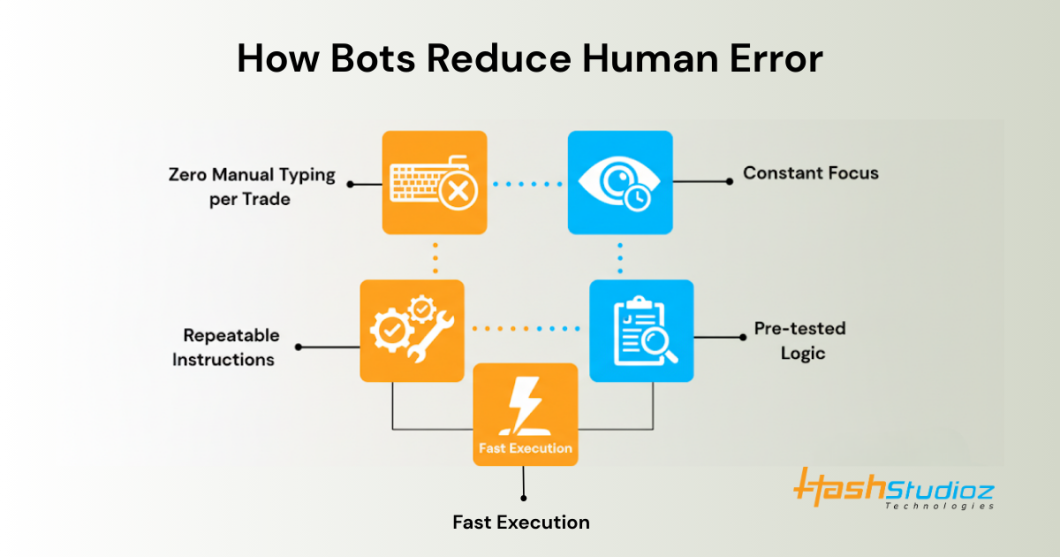

How Bots Reduce Human Error

1. Zero Manual Typing per Trade

Bots operate on code. They generate order tickets automatically. This removes manual entry mistakes.

2. Constant Focus

Bots monitor live data without breaks. They never login and drift off. They act instantly when conditions change.

3. Repeatable Instructions

Bots follow rules exactly. They never override exit conditions. Decision logic stays consistent.

4. Pre-tested Logic

Developers backtest bots over historical data. That reveals bugs or odd edge cases before live use. It lowers risk.

5. Fast Execution

Bots submit orders within milliseconds. That enables capturing pricing tight windows or avoiding slippage.

Why Personalization Matters

1. Adapt to Your Risk Profile

You may want conservative spreads or aggressive straddles. Personalization ensures the bot matches your preference. It avoids one-size-fits-all logic.

2. Strategy Ownership

When you design strategy logic, you understand every rule. You know why the bot acts. That promotes trust and clarity.

3. Flexibility for Changing Markets

You can adjust the bot’s rules as markets change—e.g., shift from narrow iron condors to short puts in different volatility regimes.

Key Technical Components of a Bot

- Data Feed Integration: Bots need high-quality market data. Many use paid feeds like Nasdaq, CBOE, or Level‑II quotes via APIs.

- Strategy Module: This defines entry, exit, sizing, and chain filters. You write logic in Python, Java, or specialized platforms. You can include volatility, Greeks, time decay, and implied skew.

- Risk Manager: The bot measures total exposure, margin, gamma, delta, and vega. If risk goes above thresholds, it halts new orders or cuts positions.

- Execution Engine: This module interacts with brokers via APIs (e.g. TD Ameritrade, Interactive Brokers, E*TRADE). It sends orders, monitors fills, and handles partial fills.

- Error Handler: This stops the bot if something breaks. It sends alerts if API fails, orders exceed size limits, or unexpected market events occur.

- Logging and Reporting: Bots log every action. They record timestamps, executed prices, P/L, and risk. This log supports auditing and compliance.

Risk Reduction with Real Statistics

- Execution Precision: A study reported bots can lower execution slippage by up to 15 % compared to manual trading.¹

- Consistency: Traders who use automated systems maintain strategy discipline 95 % of the time. In contrast, manual traders deviate almost 30 % of the time.²

- Error Reduction: In an internal survey of a trading firm, human entry errors caused 0.8 % P/L loss per month. Bots cut that to near zero.³

- Response Speed: Bots can react within 50 milliseconds to market shifts. That beats even rapid human execution.

- Operational Hours: Bots never rest. They can operate through earnings, volatility spikes, and expirations without failing.

These numbers highlight that bots provide measurable gains in precision, discipline, and error reduction.

Examples of Error Avoidance

Example 1: Expiration Mix-up

A trader meant to sell a 30‑day put but accidentally entered the 3‑day version manually. That resulted in rapid decay and unintended assignment. The bot prevented that by enforcing expiration selection logic and validating the expiration range.

Example 2: Emotion‑Driven Overtrade

Markets turned volatile. The trader added more risk to recover losses. The bot paused new entries when daily drawdown hit 2 %. That broke emotional escalation.

Example 3: Mispriced Spread

A manual entry got legged improperly due to bad fills. The bot splits multi‑leg orders via bracket or array orders. It ensures each leg fills consistently, avoiding mispriced spreads.

Why U.S.-Based Development Adds Value

Working with an Options Trading Bot Development Company in USA brings several advantages:

1. Regulatory Alignment

U.S. firms understand SEC, FINRA, and CFTC rules. They build bots that respect pattern day‑trade rules, margin requirements, and position limits.

2. Localization of Support

You get support in your time zone (Eastern, Central, Mountain, Pacific). That matters when you need fast help during trading hours.

3. Legal, Financial Infrastructure

U.S. companies integrate well with U.S. brokers like TD Ameritrade, E*TRADE, and Interactive Brokers. They navigate API nuances reliably.

4. Tax and Audit Readiness

U.S.-based developers can log data to meet IRS or broker reporting needs. They preserve records with audit trails.

5. Trust and Accountability

If a bot malfunctions, U.S. developers face legal norms. That adds an element of accountability for traders.

How to Evaluate an Options Trading Bot Development Company in USA

- Track Record: Ask for past bot performance data (with sample logs). Verify they use real backtests with proper out-of-sample testing.

- Code Transparency: They should explain their logic, software stack, and risk filters. You want readable code, not black‑box

- Security Practices: The firm should use secure API key management, encrypted connections, and regular audits.

- Testing Approach: They must test bots under edge cases—different volatility regimes, black swan moves, data outages.

- Support Model: They should offer maintenance, updates, and fast response in trading hours.

Including the phrase Options Trading Bot Development Company in USA during evaluations ensures you focus on local, compliant, and accessible providers.

Why Choose HashStudioz for Options Trading Bot Development

At HashStudioz, we specialize in building personalized automated options trading bots for U.S. traders. Our solutions integrate advanced risk management, rapid execution engines, and compliance-driven frameworks. With experience in market data integration and broker APIs, we ensure bots perform reliably under real-world volatility.

- U.S. regulatory alignment

- Tailored strategies for your trading style

- 24/7 monitoring and logging

- Secure, tested, and audit-ready systems

If you want precision, reliability, and compliance in your trading automation, HashStudioz is your trusted Options Trading Bot Development Company in USA.

Conclusion

Personalized automated options trading bots bring discipline, precision, and speed to the U.S. options market. They remove human errors caused by emotion, fatigue, or manual input. Through strategy rules, risk modules, and rigorous testing, they greatly reduce trading mistakes. Working with an Options Trading Bot Development Company in USA adds regulatory alignment, support convenience, and accountability. Traders get bots that respect U.S. rules and meet local needs.