The online travel sector generated $898 billion in global revenue during 2023, with projections hitting $1.2 trillion by 2028. Yet most OTAs aren’t capturing their fair share of this opportunity. The problem isn’t demand—it’s distribution strategy.

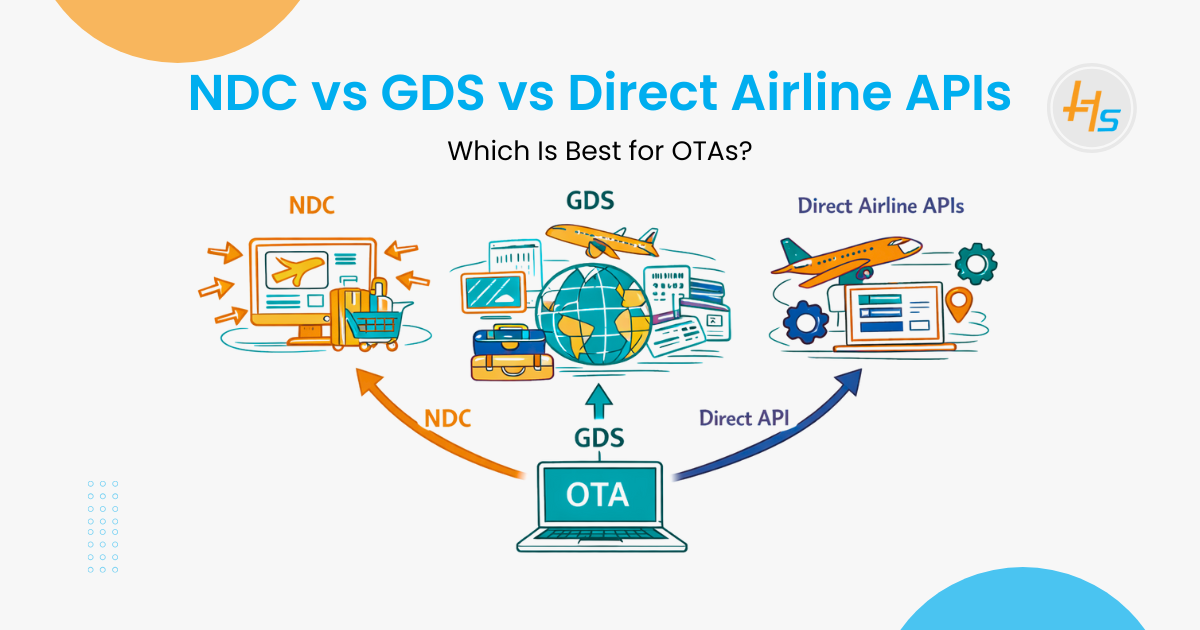

Airlines now control three distinct pathways to market: GDS as the traditional system, NDC as the newer direct channel, and exclusive direct APIs. These options support different business models across the travel ecosystem. Cost structures also vary significantly between them. Technical requirements differ as well, often influencing integration timelines and system design. Choosing the wrong approach can result in millions lost through wasted development effort or avoidable operating costs. Making the right choice, however, builds a competitive advantage that grows stronger year after year.

At HashStudioz, our teams have collaborated with dozens of OTA platforms facing this exact decision. Several startups have built profitable businesses using only GDS-based distribution. In other cases, mid-market OTAs increased margins significantly by adding well-planned NDC integrations. Enterprise clients often require more complex solutions, and we have supported them in designing multi-channel architectures that balance coverage, cost control, and product differentiation.

Table of Contents

- Understanding GDS: The Foundation That Still Powers Travel

- The NDC Shift: Why Airlines Are Pushing This Hard

- Direct Airline APIs: The Exclusive Partnership Track

- The Economics Comparison: What You Actually Pay

- Building a Distribution Strategy That Fits Your Stage

- Real Example: How We Restructured An OTA’s Distribution

- Key Considerations When Planning Your Distribution

- Why HashStudioz Helps OTAs Navigate This Choice

- Conclusion

- FAQs

Understanding GDS: The Foundation That Still Powers Travel

Global Distribution Systems—primarily Amadeus, Sabre, and Galileo—handle roughly 95% of traditional travel bookings. They’ve dominated for three decades because they solve a basic problem elegantly: they aggregate flight inventory from thousands of airlines and deliver it instantly to travel agents and OTAs worldwide.

The architecture is straightforward. Airlines upload inventory multiple times daily to GDS servers. Your OTA connects once and gains access to flights from essentially every major carrier simultaneously. A customer searches for flights. Your system queries the GDS. The GDS simultaneously queries connected airlines. Results aggregate and return within 3-8 seconds. The customer sees options and books.

This simplicity explains why countless OTAs still operate profitably on GDS alone.

How GDS Economics Work in Practice

Here’s where many OTAs get blindsided: GDS pricing compounds against your margin structure. You pay per transaction, not per customer or a monthly fee. Typically, rates range from $0.15 to $2.50 per flight segment, depending on volume and negotiating power.

Let’s look at realistic numbers. An OTA processing 50,000 monthly bookings with an average of 1.5 segments per booking (accounting for round-trips) faces 75,000 billable segments. At $0.50 per segment—a reasonable negotiated rate—that’s $37,500 monthly or $450,000 annually in distribution costs alone.

For a platform generating $30 million in annual GMV (gross merchandise value) with 12% margins, that $450,000 GDS bill consumes 12.5% of your entire profit. It’s substantial.

The GDS advantage:

- Immediate access to nearly all major airlines

- Zero technical complexity (integration takes weeks, not months)

- Standardized, proven technology with 30+ years of reliability

- Comprehensive support infrastructure

- No minimum volume thresholds to get started

The GDS limitation:

- Per-transaction fees eat margins aggressively at scale

- Competitors see identical flight offerings (no differentiation)

- Real-time pricing updates lag compared to direct connections

- No direct airline relationships for negotiated rates

- Limited ability to display ancillary products effectively

For startups and early-stage OTAs, GDS is still the right starting point. The barrier to entry is purely financial, not technical. Many platforms that eventually diversified into NDC or direct APIs started exactly here.

The NDC Shift: Why Airlines Are Pushing This Hard

Around 2012, IATA introduced the New Distribution Channel (NDC) specifically to break GDS dependency and let airlines control pricing directly. For years, adoption was glacial. Airlines couldn’t justify building NDC channels. OTAs couldn’t see the business case for custom integrations. It remained a technology looking for a problem.

Then something shifted.

By 2023, NDC bookings reached 34 million—representing 2.3% of global air ticket sales. That sounds small until you understand the growth velocity. Major carriers like American Airlines, Lufthansa, Singapore Airlines, United, and Delta started treating NDC as a strategic priority rather than an optional side project. Many airlines started limiting premium inventory to NDC-only channels. Exclusive bundled products also became available through these interfaces. In addition, real-time pricing replaced daily fare snapshots, allowing offers to reflect actual seat availability.

OTAs suddenly faced a choice: invest in NDC integration or watch competitors offer better products to customers.

What NDC Actually Changes Technically

NDC fundamentally alters how you access airline inventory. Instead of querying a middleman (GDS), your system connects directly to each airline’s NDC APIs. These connections use REST or SOAP protocols with structured XML messaging—similar to GDS architecturally, but with critical differences.

First, each airline implements NDC slightly differently. United’s API structures pricing data one way. Lufthansa does it differently. Delta adds fields that American doesn’t use. There’s no standardization across carriers. A developer building NDC integrations essentially learns multiple “dialects” of the same language.

Second, real-time updates actually happen instantly. When Lufthansa adjusts pricing or opens premium economy inventory, changes propagate to your system within seconds. Compare this to GDS, where updates are batched multiple times daily.

Third, you get substantially richer content. Ancillary pricing (seat selections, baggage, lounge access) flows directly from airline systems. Bundled offerings become programmable. You can display premium economy, basic economy, and business class with accurate pricing simultaneously instead of generic “cheapest” options.

The Development Reality of NDC Integration

We’ve implemented NDC API integration services with major carriers across multiple OTA platforms. Here’s what actually happens:

Typical timeline for single carrier integration:

- Weeks 1-2: Partnership setup and documentation review

- Weeks 3-5: Sandbox development and API familiarization

- Weeks 6-8: Core integration (search, pricing, ancillaries)

- Weeks 9-11: Error handling, edge cases, failover testing

- Week 12: Production deployment and monitoring

Three months minimum with an experienced developer. Scale that across 10 carriers and you’re looking at a 6-9 month engineering project.

But the financial case justifies it. NDC per-booking costs typically run 40-50% lower than GDS. Negotiated rates often land between $0.20-$0.35 per segment versus $0.50+ through GDS. For our example OTA at 50,000 monthly bookings, that’s $15,000-$26,250 monthly instead of $37,500.

That’s $130,000-$270,000 in annual savings before considering increased ancillary revenue.

Where NDC Creates Competitive Advantage

Beyond cost reduction, NDC enables product differentiation your GDS-only competitors can’t match.

An OTA showing basic flight options looks identical to every competitor. An OTA displaying:

- Exact seat maps with real-time availability

- Premium economy with transparent pricing

- Bundled packages (seat + checked bag + lounge)

- Loyalty program integration

…operates in a completely different category. Customers convert at higher rates. Ancillary attachment improves measurably.

We’ve observed OTAs increase ancillary revenue 15-25% after implementing proper NDC connections with major carriers. That’s not from selling more flights—it’s from monetizing each customer better because you have superior tools.

Why this matters for OTA strategy:

- Direct relationships with airlines (potential for negotiated deals)

- Exclusive product access is unavailable through GDS

- Lower per-booking distribution costs at scale

- Higher customer conversion through better product presentation

- Real-time inventory reflecting actual airline operations

Direct Airline APIs: The Exclusive Partnership Track

Direct airline APIs exist in a different universe entirely.

These aren’t published services. There’s no public documentation. Airlines don’t advertise them. They’re proprietary integrations offered exclusively to OTA partners with sufficient booking volume and strategic value.

We’ve helped clients access direct APIs from carriers like Emirates, Cathay Pacific, and others. The requirements are confidential. The process takes months. The payoff is substantial if you qualify.

How Direct API Partnerships Actually Work

An airline decides that a particular OTA is valuable enough to justify custom development. This happens for different reasons:

- Volume-based: You’re booking 500,000+ segments annually with that carrier

- Strategic: You control market share in a specific geography that they prioritize

- Brand alignment: Your customer base matches their brand positioning

The airline assigns a dedicated technical team and relationship manager. You work in their sandbox environment for months, learning their proprietary API design and business logic. Implementation typically takes 4-6 months for a mature platform.

Example: One of our clients secured a direct API with a Middle Eastern carrier. The benefit? Access to premium economy inventory at wholesale pricing, available 48 hours before GDS distribution. Their competitors purchased premium economy through normal channels at standard markups. Our client could offer meaningful price advantages on premium economy, attracting customers willing to pay more for seat comfort.

Within 18 months, premium economy represented 8% of their bookings (normally 2-3% industry average). That translated to $2.1 million in additional annual revenue from a single carrier relationship.

The True Cost of Direct API Development

Initial development investment runs $200,000-$500,000, depending on API complexity. That’s just getting to production. Ongoing maintenance requires dedicated engineers—airlines update APIs, change authentication protocols, and roll out new features. You need resources to stay current with every change.

You also face genuine vendor lock-in. Your system architecture gets designed around that specific API. Losing access creates operational headaches.

This model only makes sense if:

- You’re already processing significant volume with that carrier

- The special pricing justifies 6+ month development timelines

- You can allocate dedicated engineering resources

- The partnership is stable and long-term

The Economics Comparison: What You Actually Pay

Let’s model three realistic scenarios for an OTA processing 60,000 monthly bookings (90,000 billable segments with connections):

First Scenario: GDS-Only Approach

- Per-segment cost: $0.50

- Monthly distribution cost: $45,000

- Annual cost: $540,000

- Upfront investment: $8,000-$12,000

- Required staff: 1-2 people managing operations

- Typical timeline to launch: 4-6 weeks

Second Scenario: GDS + Strategic NDC (4 Major Carriers)

- GDS coverage: 50,000 segments × $0.40 = $20,000

- NDC coverage: 40,000 segments × $0.25 = $10,000

- Total monthly cost: $30,000

- Annual cost: $360,000 ($180,000 annual savings vs. GDS-only)

- Upfront investment: $160,000-$220,000 (development)

- Required staff: 3-4 people (integration + management)

- Timeline to full implementation: 4-5 months

Third Scenario: GDS + NDC + One Direct API Partnership

- GDS: 40,000 segments × $0.38 = $15,200

- NDC: 35,000 segments × $0.22 = $7,700

- Direct API: 15,000 segments × $0.18 = $2,700

- Total monthly cost: $25,600

- Annual cost: $307,200 ($232,800 annual savings vs. GDS-only)

- Upfront investment: $320,000-$450,000

- Required staff: 4-5 people (dedicated integration team)

- Timeline: 6-7 months for full deployment

These savings accelerate as volume grows. An OTA hitting 200,000 monthly bookings through scenario 3 saves nearly $1 million annually compared to pure GDS operations.

However, scenario 3 demands serious technical capability. A bootstrap startup can’t execute this. A platform with established revenue and engineering depth can’t ignore the margin opportunity.

Building a Distribution Strategy That Fits Your Stage

The right approach depends on where your platform operates in its lifecycle.

For Pre-Launch and Startup OTAs

Start with GDS. Period. The barrier is purely financial—you can operate profitably on GDS at any volume level. The technical complexity is minimal. You need one competent developer, 4-6 weeks, and you’re processing bookings.

Focus engineering resources on product experience, customer acquisition, and fulfillment. Let GDS handle distribution while you validate market fit and build revenue.

Once you’re processing consistent monthly volume and have revenue to reinvest, evaluate your top 5-10 carriers. If those carriers represent 40-50% of your bookings, NDC integration becomes financially compelling.

For Growth-Stage OTAs ($10M-$100M GMV)

This is where distribution decisions significantly impact profitability. Most platforms at this stage run:

- GDS for comprehensive coverage and secondary carriers

- NDC integrations with top 10-15 carriers (covering 70-80% of bookings)

- Initial direct API exploration with 1-2 strategic partners

This hybrid approach maximizes coverage while optimizing costs. You’re not betting everything on any single channel. You maintain fallback options. You spread technical risk across multiple systems.

Implementation happens progressively. The first year might focus on GDS foundation with early NDC pilots. In year 2 adds broader NDC deployment, and in year 3 pursues direct API partnerships.

For Enterprise Platforms ($500M+ GMV)

Large OTAs essentially build a portfolio approach. They maintain relationships across all three channels while negotiating exclusive arrangements with individual airlines outside standard frameworks. They optimize each carrier relationship independently based on volume, strategic value, and available leverage.

These platforms often employ 20+ engineers solely focused on distribution and airline relationships. They write custom integration frameworks allowing rapid deployment across channels. They maintain sophisticated pricing algorithms optimizing distribution across multiple channels simultaneously.

Real Example: How We Restructured An OTA’s Distribution

One of our clients—a mid-market OTA handling 250,000 monthly bookings—was spending $2.1 million annually on GDS fees. They had a strong market position but thin margins. Distribution costs represented nearly 18% of their total operating expenses.

Here’s what we implemented:

Phase 1 (Months 1-5): NDC Pilot with Top 8 Carriers

- Investment: $180,000 in development

- Implementation: Built NDC integrations with Lufthansa, United, American, Delta, Southwest, Air France, British Airways, and Emirates

- Result: 65% of bookings migrated to NDC; GDS costs dropped from $2.1M to $750,000 annually

- Additional benefit: Ancillary revenue increased 12% through better product presentation

During (Months 6-12): Direct API with Strategic Partner

- Investment: $250,000 in specialized development

- Implementation: Secured direct API access with one major Middle Eastern carrier

- Result: 5% of bookings through direct API with 35% cost advantage; annual savings of $120,000

- Additional benefit: Exclusive inventory access strengthened market position in Asian markets

By (Months 13-18): NDC Expansion to Next Tier

- Investment: $120,000 (leveraging existing frameworks)

- Implementation: Extended NDC to the next 10 carriers

- Result: Total NDC coverage increased to 82% of bookings

Final Numbers After 18 Months:

- Distribution cost reduction: $2.1M → $1.2M annually

- Total investment: $550,000

- Annual recurring savings: $900,000

- ROI on investment: 20 months

- Ancillary revenue improvement: 22% total increase

- Net margin improvement: 3.2 percentage points

This client transformed from a thin-margin volume player to competitive profitability. They maintained GDS fallback coverage while systematically shifting high-volume bookings to cheaper, better-performing channels.

Key Considerations When Planning Your Distribution

Beyond cost and technical requirements, several factors demand attention:

- Relationship complexity escalates. GDS requires monitoring and occasional support tickets. NDC adds partner management—coordinating with 10+ airlines on API updates and special programs. Direct APIs demand a dedicated relationship, ownership tracking, partnership performance, and business changes.

- Testing infrastructure gets complicated. GDS integration needs basic testing. NDC requires testing across different airline systems with different response formats and edge cases. Direct APIs might lack comprehensive sandbox environments, making testing incomplete until production deployment.

- Failure scenarios multiply. GDS failure loses everything. NDC failure with one airline loses that carrier but maintains others. Direct API failure for one carrier creates service gaps if that’s your only premium inventory source.

- Staff expertise becomes critical. Any competent developer integrates GDS. NDC demands developers comfortable with real-time inventory systems and API integration patterns. Direct APIs require engineers experienced with custom integrations and comfortable working directly with airline technical teams.

- Vendor relationships require management. GDS relationships are transactional. NDC relationships are partnerships requiring occasional check-ins and alignment discussions. Direct API relationships demand active management—they’re valuable and can be revoked if performance expectations aren’t met.

Why HashStudioz Helps OTAs Navigate This Choice

At HashStudioz, our entire team has built travel technology from the ground up. We’ve implemented GDS integrations, NDC API integration services, and direct airline APIs. We’ve helped platforms make distribution decisions at every stage—from pre-launch through enterprise scale.

We understand the technical implementation because we’ve done it. We understand the business implications because we’ve watched outcomes across dozens of platforms.

When you work with HashStudioz on a distribution strategy, you’re not getting generic advice. You’re getting guidance based on:

- Actual implementation experience across GDS, NDC, and direct channels

- Real financial data from platforms similar to yours

- Technical roadmaps accounting for your engineering capacity

- Risk assessments identifying potential complications

- Phased implementation timelines matching your growth stage

Whether you need GDS foundation setup, NDC integration architecture, or a complete multi-channel strategy, we guide the technical implementation while you focus on customer experience and market positioning.

Conclusion

The distribution decision isn’t about picking a winner—it’s about choosing what fits your stage. Startups should start with GDS. Growth-stage platforms benefit from GDS plus strategic NDC. Enterprise platforms justify complex multi-channel strategies.

The common factor across successful platforms? Making an intentional choice aligned with actual business numbers, not what competitors do or what airlines say you “should” do.

Ready to optimize your distribution strategy? HashStudioz helps OTA platforms assess current position, model financial scenarios, and build specific implementation roadmaps. Contact us for a free distribution strategy assessment.

FAQs

Q1: Can we build a profitable OTA using only GDS?

Yes. Many platforms operate profitably on GDS-only. Profitability depends on efficiency and customer acquisition, not the distribution channel.

Q2: How long does NDC implementation take?

Initial integration with one carrier takes 3-4 months. Subsequent integrations are completed in 8-10 weeks using reusable frameworks.

Q3: What percentage of bookings flow through NDC currently?

NDC represented 2.3% of global bookings in 2023, with projections reaching 10-15% by 2026.

Q4: At what volume does NDC make financial sense?

Generally, around 100,000-200,000 monthly bookings, or when top 5-10 carriers represent 50%+ of your volume.

Q5: Do direct APIs provide better pricing than NDC?

Yes, for exclusive partners. Direct APIs offer superior rates, but require significant booking volume to justify investment.