In recent years, the banking industry has undergone a major shift due to technologies like IoT and cloud computing. These innovations are transforming how banks operate, offer services, and engage with customers. According to Statista, the global IoT in banking market is projected to reach $39.39 billion by 2026, showing increased adoption. Smart ATMs and interactive kiosks, powered by IoT and cloud systems, are key disruptions. They streamline processes, improve user experience, and make banking more accessible. Smart ATMs, for instance, are expected to automate 30% of banking transactions by 2025, making services more secure and customer-centric.

Table of Contents

- Understanding Smart ATMs and Kiosks

- How IoT Transforms Banking with Smart ATMs and Kiosks

- Case Studies of Banks Utilizing Smart ATMs and Kiosks

- Challenges and Considerations

- Future Trends in IoT and Banking

- How IoT and Cloud Are Disrupting Traditional Banking

- Why IoT and Cloud are Crucial for Modern Banking

- HashStudioz Services for the Banking Industry:

- Partner with HashStudioz for a Smarter Future in Banking

- Conclusion

- FAQs

Understanding Smart ATMs and Kiosks

A. Definition of Smart ATMs and Kiosks

Smart ATMs and interactive kiosks are next-gen banking devices that blend traditional ATM functions with advanced digital technologies. While traditional ATMs mainly dispense cash, smart ATMs offer features like biometric authentication, advanced interfaces, and real-time transaction monitoring. Interactive kiosks allow customers to perform tasks such as bill payments, check deposits, and account management without human interaction.

B. Key Functionalities Compared to Traditional ATMs

Unlike traditional ATMs, which are typically limited to cash withdrawals and balance checks, smart ATMs can offer features such as:

- Multi-functionality: Support for a range of services, including bill payments, cheque deposits, and loan applications.

- Biometric Authentication: Fingerprint, facial recognition, and other biometric features for enhanced security.

- Real-Time Data Processing: Integration with cloud platforms allows for instant updates on account balances and transaction history.

- Remote Connectivity: Real-time updates and troubleshooting through IoT connectivity.

Interactive kiosks, on the other hand, are designed for a more engaging user experience, offering services such as video chat with bank agents, financial advice, and personalized recommendations based on customer profiles.

How IoT Transforms Banking with Smart ATMs and Kiosks

A. Enhanced Customer Experience

1. Personalization through Data Analytics

IoT-enabled banking devices, particularly smart ATMs and kiosks, can collect data from customers and use it to personalize interactions. By integrating data from user transactions, preferences, and behaviors, banks can offer personalized services, such as tailored product recommendations, instant access to financial advice, or customized promotions.

2. Faster Transactions and Improved Accessibility

With real-time data processing and cloud integration, smart ATMs enable faster and more efficient transactions. Instead of waiting for a bank representative or visiting a physical branch, customers can access most of their banking needs 24/7 through these devices. Additionally, smart ATMs and kiosks often offer a more intuitive interface, making it easier for customers to navigate banking functions.

3. 24/7 Service Availability

One of the most significant advantages of smart ATMs and kiosks is the ability to provide round-the-clock services. Whether it’s accessing funds, paying bills, or receiving banking support, these devices operate 24/7, offering unmatched convenience for customers who may not be able to visit a branch during traditional banking hours.

IoT in Big Data: How Connected Devices Drive Actionable Insights

B. Security Improvements

1. Advanced Authentication Methods

Traditional ATMs often rely on PINs or magnetic stripe cards for security, which can be vulnerable to hacking and fraud. Smart ATMs and kiosks, however, use advanced authentication methods such as biometric recognition, facial scans, or fingerprint verification to ensure secure transactions. This added layer of security reduces the risk of fraud and identity theft.

2. Real-Time Monitoring and Fraud Detection via Cloud Analytics

By integrating cloud-based analytics, IoT devices can continuously monitor activities on smart ATMs and kiosks in real-time. This allows for immediate detection of suspicious activities, such as unauthorized access attempts or fraudulent transactions. Banks can use this data to initiate automatic fraud alerts or remotely disable machines when security threats are detected.

C. Operational Efficiency

1. Remote Management and Troubleshooting

The IoT technology in smart ATMs and kiosks allows for remote management, meaning that issues such as software malfunctions or hardware failures can be detected and resolved without the need for onsite technicians. Banks can perform routine maintenance and software updates remotely, minimizing the need for physical visits and ensuring uninterrupted service.

2. Predictive Maintenance to Reduce Downtime

IoT-enabled smart ATMs and kiosks can track the health of their components and send alerts when maintenance is required. Predictive maintenance ensures that machines are serviced before they break down, reducing costly downtime and improving the overall reliability of the banking network.

Case Studies of Banks Utilizing Smart ATMs and Kiosks

A. Case Study 1:

One leading financial institution implemented a fleet of smart ATMs equipped with biometric authentication and cloud connectivity. This allowed customers to perform transactions faster and more securely. The result was a significant reduction in fraudulent activities and an increase in customer satisfaction. The bank also reported a 30% decrease in operational costs due to the remote management capabilities of these machines.

B. Case Study 2:

Another bank deployed interactive kiosks in its branches to engage customers in a more personalized way. These kiosks provided customers with the ability to interact with virtual assistants and receive tailored financial advice. As a result, customer engagement increased by 25%, and the bank saw a 20% improvement in customer retention rates.

Challenges and Considerations

A. Technical Challenges

1. Connectivity Issues and Infrastructure Requirements

For smart ATMs and kiosks to function optimally, banks must invest in robust connectivity infrastructure. In regions with unstable internet connections or limited bandwidth, it could be challenging to deploy IoT-enabled devices effectively.

2. Integration with Existing Banking Systems

Integrating new technologies with legacy banking systems can be a complex task. Banks need to ensure that their IoT-enabled devices seamlessly interact with their core banking platforms, which may require additional software development and system updates.

B. Security Concerns

1. Addressing Vulnerabilities in IoT Devices

IoT devices are often seen as a potential entry point for cyberattacks. Ensuring the security of smart ATMs and kiosks is critical to prevent data breaches and hacking. Banks must implement strong encryption, secure APIs, and regular security audits to mitigate these risks.

2. Strategies for Combating Hacking and Data Breaches

Banks must employ a multi-layered security approach to safeguard data on IoT devices. This includes deploying encryption techniques, securing communication channels, and using advanced anomaly detection systems to identify and block suspicious activity.

C. Customer Adaptation

1. Resistance to Change Among Traditional Bank Customers

While IoT-powered smart ATMs and kiosks offer many advantages, some customers may be resistant to change. Banks need to invest in customer education to ensure that users understand how to use these new technologies effectively and securely.

2. Educating Users on New Technologies

To overcome resistance, banks should provide training resources, video tutorials, and customer support to help users become comfortable with smart ATMs and kiosks. Clear instructions and a simple user interface can also make the transition smoother.

Future Trends in IoT and Banking

As technology continues to advance, the potential for IoT in banking is limitless. Here are some future trends:

- AI and Machine Learning: These technologies will be integrated into smart ATMs and kiosks to enhance personalization, security, and transaction processing.

- Blockchain Integration: Blockchain could be used to provide secure and transparent transaction records, further strengthening the security of smart ATMs and kiosks.

- Expansion of Services: Beyond basic banking functions, future smart ATMs and kiosks could offer services like investment advice, personalized loans, and even virtual financial planning sessions.

The convergence of the Internet of Things (IoT) and cloud computing is significantly reshaping the banking industry. With the integration of these advanced technologies, banks can offer smarter, more efficient services, transforming the way customers interact with financial institutions. Among the most notable innovations are smart ATMs and interactive kiosks, both powered by IoT and cloud systems. These devices provide enhanced functionalities, increase operational efficiency, and improve the overall customer experience.

Connecting IoT To The Cloud: Security Challenges And Solutions

How IoT and Cloud Are Disrupting Traditional Banking

- Smart ATMs:

Smart ATMs are revolutionizing banking by automating tasks that once required human intervention, such as cash deposits, balance inquiries, and even biometric authentication. These ATMs can perform real-time data processing by integrating IoT sensors and cloud computing, ensuring faster transaction times and seamless operations. - Interactive Kiosks:

These self-service kiosks allow customers to perform various banking functions such as account opening, loan applications, check deposits, and more. IoT sensors embedded in these kiosks collect data about customer interactions, which is processed and stored in the cloud for real-time analysis. - Operational Efficiency and Data Management:

Cloud-based systems enable banks to centralize and analyze vast amounts of data generated by IoT devices. Additionally, IoT-connected devices can remotely monitor and maintain assets like ATMs and kiosks, ensuring that issues are identified and resolved before they disrupt service.

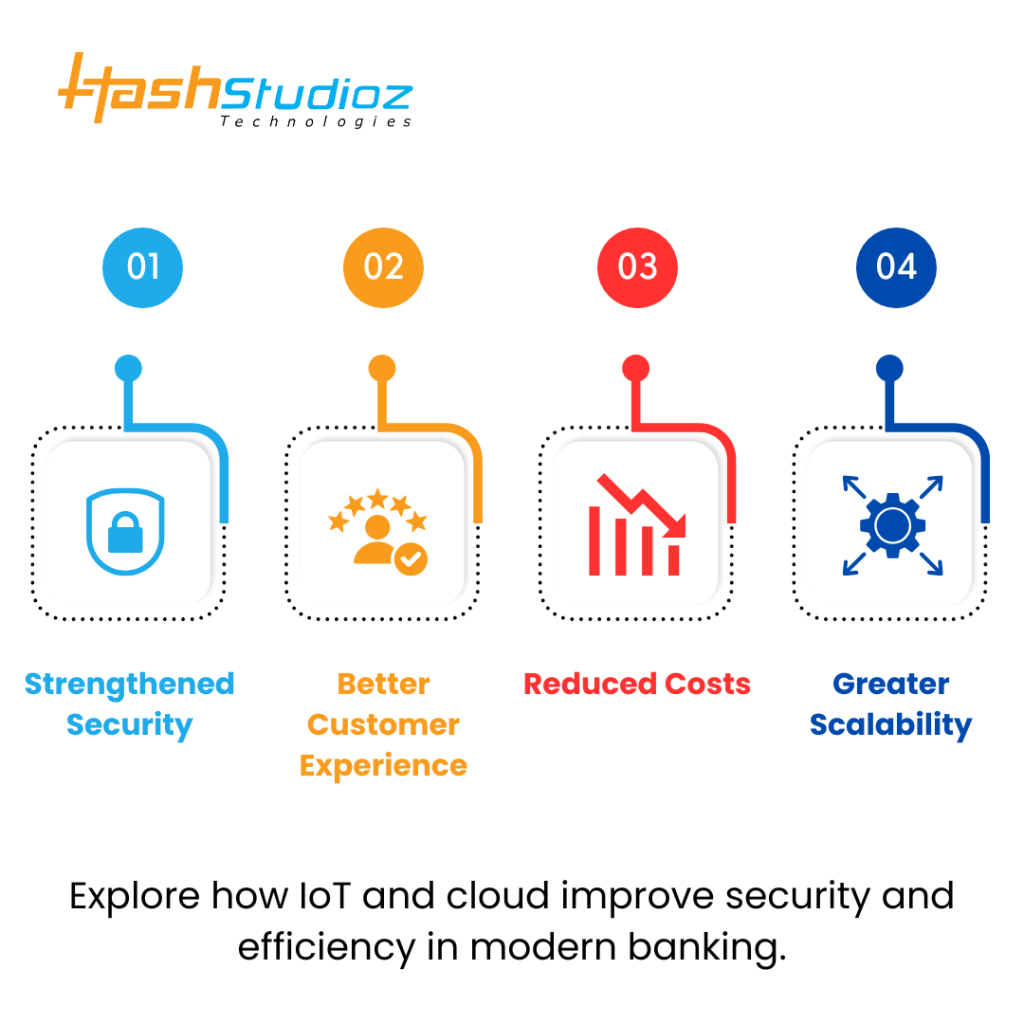

Why IoT and Cloud are Crucial for Modern Banking

- Enhanced Security: IoT devices, like smart ATMs, provide higher security features such as biometric authentication and AI-driven fraud detection. Data stored in the cloud can be encrypted and securely accessed.

- Improved Customer Experience: Through IoT-powered kiosks and ATMs, banks provide 24/7 services, offering customers the convenience to conduct banking tasks on their own terms.

- Cost Reduction: Automating tasks with IoT and cloud systems reduces the need for physical branches and staff, leading to significant cost savings for banks.

- Scalability: Cloud computing allows banks to scale their operations easily. Whether adding more smart devices or expanding data storage, cloud infrastructure provides the flexibility and capacity required for growth.

HashStudioz Services for the Banking Industry:

HashStudioz is at the forefront of transforming the banking sector by providing innovative IoT and cloud-based solutions. Our expertise lies in helping financial institutions optimize their operations and customer services through cutting-edge technology. Here’s how we can help your bank:

- IoT and Cloud Integration: We offer seamless integration of IoT devices (smart ATMs, kiosks) with cloud platforms, ensuring secure data transfer, real-time analytics, and operational efficiency.

- Custom Software Solutions: Our team creates custom software solutions tailored to your bank’s specific needs, whether it’s for smart ATMs, interactive kiosks, or complete digital transformation.

- Data Analytics and Insights: We utilize advanced cloud-based analytics to provide actionable insights into customer behavior, operational performance, and security risks.

- Security Solutions: Our IoT-powered security systems use biometric and AI-driven technologies to enhance fraud prevention and ensure compliance with banking regulations.

- Ongoing Support and Maintenance: We provide 24/7 monitoring and maintenance services for IoT-enabled banking devices, ensuring they remain operational and secure.

Partner with HashStudioz for a Smarter Future in Banking

The future of banking is here, and it’s powered by IoT and cloud technologies. With HashStudioz’s expertise in delivering smart solutions, we can help your bank harness the power of smart ATMs, interactive kiosks, and advanced data analytics to stay competitive in an increasingly digital world. Contact us today to learn how we can help you transform your banking services and provide an exceptional customer experience.

Conclusion

The integration of IoT technology into traditional banking systems, particularly through smart ATMs and kiosks, is transforming the industry. By providing enhanced customer experiences, improving security, and increasing operational efficiency, these devices are disrupting traditional banking services. Banks that adopt these innovations stand to gain a competitive edge by offering more convenient, personalized, and secure services to their customers.

FAQs

How does IoT impact cloud-based banking?

IoT enables real-time data collection and analysis, improving services, security, and efficiency in banking.

How do smart ATMs benefit banking?

Smart ATMs streamline transactions, reduce costs, and enhance customer experience with features like biometric authentication and cash deposits.

What advantages do interactive kiosks offer?

Interactive kiosks allow self-service banking, reducing wait times and increasing convenience for customers.

How does the cloud improve IoT devices in banking?

Cloud systems centralize data processing, optimize performance, and enable scalability for IoT-powered banking devices.

What security is provided for IoT banking devices?

Advanced encryption, biometric verification, and real-time fraud detection protect IoT devices in banking systems.